Award-winning PDF software

How to prepare Form 1040 (Schedule B)

1

Open up a fillable Form 1040 (Schedule B)

Simply click Get Form to start the blank in our editor. There is not any necessity to download the document-you can fill out the form online from any device.

2

Complete the document

Complete the file within a practical editor, supplying precise details in every area. Put your digital signature if needed.

3

Share the document with others

After the record is filled out, you can save it in the recommended formatting, download it, or print out it. It is easy to deliver it by electronic mail, USPS and fax or Text message.

What Is Schedule B?

Online solutions enable you to arrange your document management and enhance the efficiency of the workflow. Observe the quick information in an effort to fill out Irs Schedule B, avoid mistakes and furnish it in a timely way:

How to complete a Schedule B 2019?

- On the website hosting the form, click on Start Now and pass for the editor.

- Use the clues to fill out the appropriate fields.

- Include your individual information and contact information.

- Make sure you enter appropriate data and numbers in proper fields.

- Carefully check the content of the form as well as grammar and spelling.

- Refer to Help section if you have any concerns or contact our Support staff.

- Put an electronic signature on the Form 1040 (Schedule B) printable using the assistance of Sign Tool.

- Once blank is done, click Done.

- Distribute the ready form by using electronic mail or fax, print it out or download on your device.

PDF editor permits you to make alterations to your Form 1040 (Schedule B) Fill Online from any internet connected device, customize it in accordance with your needs, sign it electronically and distribute in several approaches.

Things to know about Form 1040 (Schedule B)

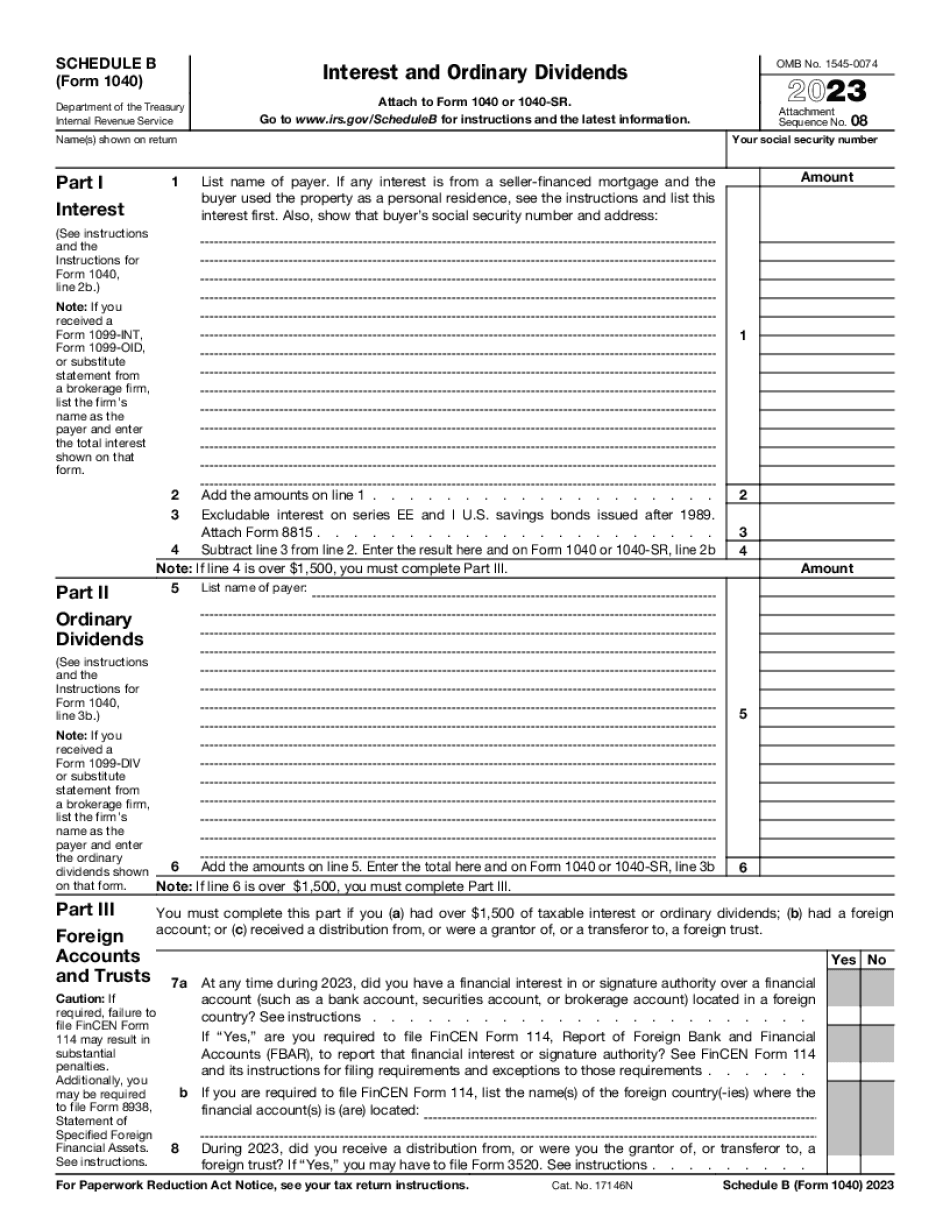

What is the Form Schedule B for 2023?

The Form Schedule B is an essential tax form that individuals or businesses use to report their interest and dividend income. It provides the Internal Revenue Service (IRS) with detailed information about the interest and dividend income earned during a specific tax year.

For the tax year 2023, the Form Schedule B will contain fields to report interest income from various sources such as bank accounts, savings accounts, certificates of deposit (CDs), and bonds. It is important to note that not all interest income needs to be reported on this form. Generally, if the total interest income is below a specific threshold (determined by the IRS), it may not need to be reported.

Additionally, Schedule B also requires reporting of dividend income from stocks, mutual funds, and other investments. Similar to interest income, not all dividend income needs to be reported if it falls under specific thresholds.

Form Schedule B typically has several parts in which the taxpayer needs to provide their personal information, such as name, address, and taxpayer identification number. It also asks specific questions about certain financial activities, like foreign accounts or holdings, or participation in tax-exempt bond transactions. These questions are intended to help the IRS identify potential taxable income that might have been omitted.

It's important to remember that Schedule B is an attachment to the main tax return form, which is either Form 1040 or one of its variants (such as Form 1040A or Form 1040EZ). So, when filing taxes for the year 2023, taxpayers who have interest or dividend income meeting the reporting thresholds will need to complete and submit the corresponding Form Schedule B along with their main tax return form.

When filling out Form Schedule B, taxpayers should ensure accuracy and include all the necessary information to prevent potential issues or audit triggers. It is advisable to consult a tax professional or utilize tax software to ensure compliance with the latest IRS guidelines and regulations.

Always remember that tax laws change over time, so it's crucial to consult the most recent instructions and guidelines provided by the IRS regarding Form Schedule B for the relevant tax year, in this case, 2023.

What is a 1099 B form?

A 1099-B form is a tax document used to report capital gain or loss from the sale or exchange of certain assets. Here's some relevant content explaining this topic further:

Title: Understanding the 1099-B Form: Reporting Capital Gains and Losses

Introduction:

The 1099-B form is a crucial document used to report any capital gains or losses you've incurred during a tax year. This form is primarily used to report the sale or exchange of securities, such as stocks, bonds, mutual funds, or other investment assets. In this article, we'll delve deeper into what a 1099-B form is, why it matters, and how you can navigate this tax requirement.

1. Key Elements of a 1099-B form:

The 1099-B form contains essential information about your transactions, such as the date of sale, description of the asset, cost basis, proceeds, and the resulting gain or loss. It also provides details about whether the transaction was short-term or long-term, based on the holding period.

2. Reporting Capital Gains and Losses:

When you receive a 1099-B form, you must report the information it contains on your tax return. If you've received multiple forms, you should consolidate them to account for all your transactions accurately. Capital gains or losses are reported on Schedule D of Form 1040 or 1040-SR, depending on your filing status.

3. Cost Basis and Adjustments:

The cost basis of an asset is generally the original purchase price plus any additional expenses incurred during the acquisition. However, adjustments might be necessary, such as for stock splits, dividends reinvested, or capital improvements. Understanding the proper cost basis and related adjustments is crucial for accurate reporting.

4. Different Categories of Capital Gains and Losses:

Capital gains and losses can be divided into two main categories: short-term and long-term. Short-term gains or losses occur when the asset is held for less than one year, while long-term gains or losses apply to assets held for over a year. Each category has its own tax rates and implications.

5. Brokers and Reporting Requirements:

If you have engaged with a broker for your investment transactions, they are responsible for providing you with a 1099-B form. Brokers are required to report accurate information based on your transactions, so it's essential to verify the details provided by them.

Conclusion:

Familiarizing yourself with the 1099-B form is essential for anyone involved in investment activities. Understanding the elements of this form, reporting requirements, cost basis adjustments, and the different types of capital gains and losses will enable you to accurately report your transactions, ensuring compliance with the IRS. By staying informed and organized, you can efficiently handle your tax obligations related to capital gains and losses.